Increased mortgage rates have hit housing affordability in the UK, according to new figures from lender Nationwide, with first time buyers now facing levels last seen in the run up to the financial crisis.

The average price of a home jumped by £3,301 this month, at the same time as Rightmove saw double the amount of inquiries from prospective buyers.

It may not stave-off recession, according to inflation data expert.

Are prices in England & Wales still rising?

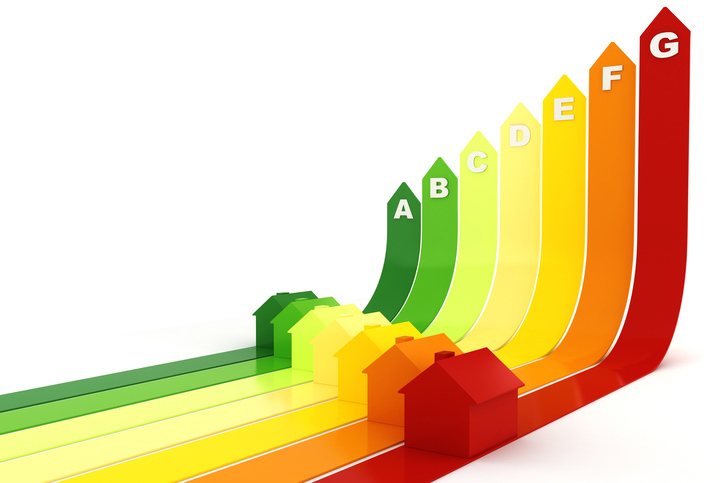

Energy efficiency will become key considerations for buyers next year while those with cash will be preferred purchasers, Jackson-Stops has predicted.

Buy-to-let lenders need to ready themselves for a “prolonged period of stress” when it comes to assessing mortgage applications, the Bank of England has warned.

Two pillars have long held up hundreds of thousands of retirement dreams: the stock market and the property market. Cracks have emerged in both this year. Savers relying on their workplace pension have watched the value of their pots sink, thanks to a twin sell-off in both the bond and stock markets.

An accountancy firm says that 70,000 buy-to-let landlords have exited the UK’s rental market over the last 12 months.

- The Most Searched for Locations Of 2022

- How Prices Have Risen by up to 20% Since Pandemic

- The UK’s House Prices Continue to Fall

- Housing Market Fueled by 20% Drop in Building Work as UK

- What Will Happen to House Prices and Mortgages in 2023?

- Landlords Swoop On Housing Downturn To Snap Up Bargain Properties

- Private Rents Continue To Rise, ONS Data Shows

- UK Inflation Eases In November