The Mayor of London Sadiq Khan has today joined council leaders, trade unions and other organisations in calling on Secretary of State for Levelling Up, Housing and Communities Michael Gove to implement a freeze on private rents and a ban on evictions.

Figures indicate "a possible slowing of the housing market"

With savers receiving poor returns from banks and building societies, thousands of people unsurprisingly continue to turn to residential property as a means of supplementing their income, supported by high demand from tenants and stable yields, as buy-to-let remains the investment of choice.

The 10.1% figure is marginally down from the 10.5% previously recorded and means inflation has fallen further back from a 41-year high of 11.1% recorded in October.

Zoopla has launched a property inheritance calculator to help children work out what support they could get from the Bank of Mum and Dad to help them onto the property ladder.

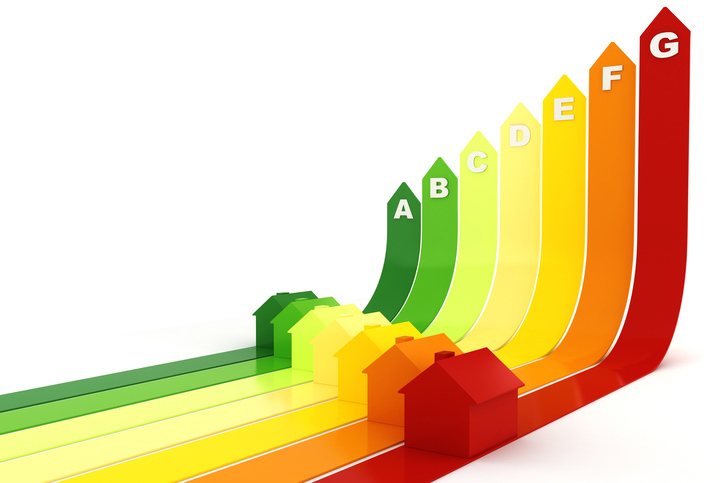

Landlords have spent nearly £9,000 on improvements to meet proposed EPC requirements, according to new research.

Almost a third of private landlords with a buy-to-let mortgage face the prospect of significantly higher costs this year according to new research.

- What now for the housing market?

- Private Renting Sector Vital to Economy

- Government Urged to Address Chronic Undersupply of Housing

- Mortgage Rates Fall in Fierce Price War

- Nationwide Reveals Latest on UK House Prices

- UK Economy Narrowly Avoids Recession

- Landlords Look to Increase Rents to Offset Successive Hikes in Interest Rates

- North-South House Price Divide is Narrowing