2021 has seen the busiest H1 ever, according to data recorded by Rightmove, while average house prices coming to the market have hit a record high for the fourth consecutive month.

There are currently 41 buy-to-let (BTL) mortgages at the record low rate of 1.5% or below, according to data from online buy-to-let mortgage broker, Property Master.

Investors are receiving more income from tenants, as UK rents have increased by 8.5% year-on-year, the Hamptons Monthly Lettings Index for June has revealed.

UK house prices rose 13.4% in the year to June, the fastest pace since November 2004, the Nationwide has said.

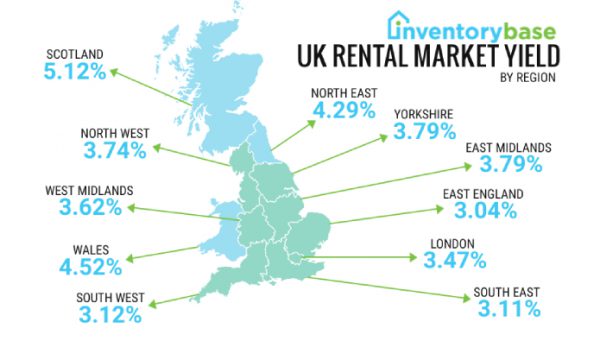

When it comes to investing in property, strong rental yields are all-important if you want to make decent money out of bricks and mortar and generate a good return on your investment.

Last month June 23), to be exact – marks five years since the EU referendum.

Research from the homebuying platform, YesHomebuyers, has found that demand for chain-free properties has climbed across the UK’s major cities as many homebuyers look to minimise current market delays for a fast property purchase.

Andy Foote of SevenCapital was speaking earlier this month and said, "at some point during their career, many people will question, pension or property? As the retirement age rises, and the cost of living increases, this age-old debate is becoming increasingly common."

- Homes Near Transport Hubs Still Carry Massive Premium

- Too Many Buyers and Not Enough Sellers is Squeezing the Market – Rics Residential Market Survey

- Bank of England Warns on Interest Rates if House Prices Rocket

- GOVT Launches First Homes Scheme

- First Time Buyers See Cost of Buying Rise 10% Year on Year

- The Best Cities For Renting Out Property

- House Prices Set for Sharp Rise This Summer

- Average Asking Price Hits £333,564